All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance coverage right up to line of it ending up being a Modified Endowment Agreement (MEC). When you use a PUAR, you rapidly raise your cash value (and your death benefit), therefore enhancing the power of your "bank". Even more, the more cash money value you have, the greater your passion and dividend repayments from your insurance firm will be.

With the rise of TikTok as an information-sharing system, financial recommendations and approaches have actually located an unique way of dispersing. One such technique that has actually been making the rounds is the unlimited banking concept, or IBC for brief, garnering endorsements from celebs like rap artist Waka Flocka Fire. While the approach is currently popular, its roots trace back to the 1980s when economist Nelson Nash introduced it to the world.

How long does it take to see returns from Infinite Wealth Strategy?

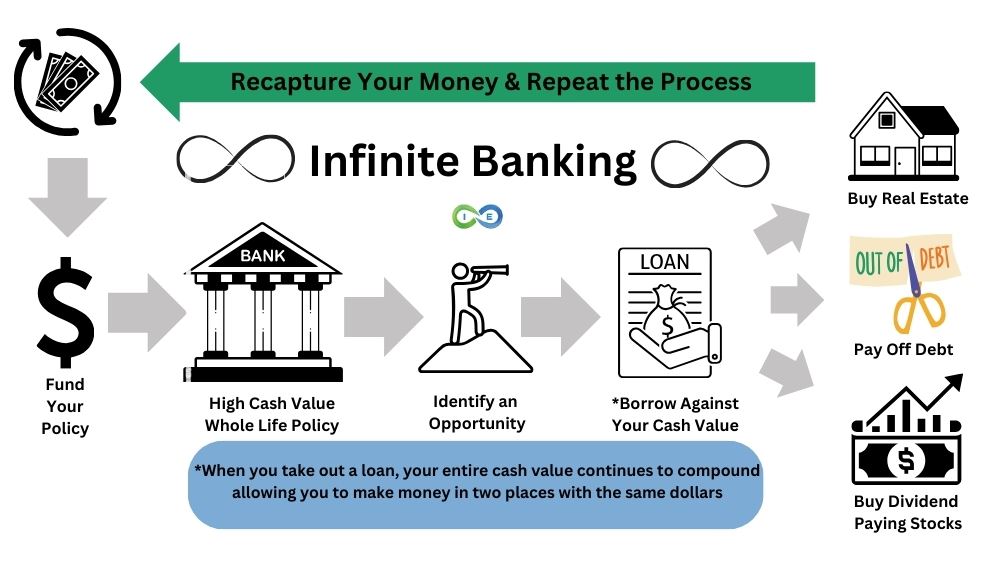

Within these plans, the money worth expands based on a rate set by the insurance firm (Wealth building with Infinite Banking). Once a considerable cash money worth collects, insurance holders can get a cash worth financing. These fundings vary from conventional ones, with life insurance policy working as collateral, implying one could shed their protection if borrowing excessively without ample money value to support the insurance prices

And while the allure of these policies is noticeable, there are inherent limitations and risks, necessitating persistent cash worth surveillance. The technique's authenticity isn't black and white. For high-net-worth people or organization owners, specifically those using techniques like company-owned life insurance coverage (COLI), the advantages of tax breaks and substance growth could be appealing.

The allure of boundless banking doesn't negate its challenges: Cost: The fundamental demand, a permanent life insurance coverage plan, is pricier than its term equivalents. Qualification: Not every person receives entire life insurance policy because of strenuous underwriting processes that can omit those with certain health or way of life conditions. Complexity and threat: The elaborate nature of IBC, paired with its threats, might deter numerous, particularly when less complex and less dangerous options are readily available.

What is the best way to integrate Financial Independence Through Infinite Banking into my retirement strategy?

Assigning around 10% of your month-to-month income to the plan is just not possible for the majority of individuals. Part of what you read below is just a reiteration of what has actually currently been said over.

Prior to you obtain yourself right into a circumstance you're not prepared for, know the adhering to first: Although the principle is frequently marketed as such, you're not in fact taking a finance from yourself. If that held true, you would not have to settle it. Instead, you're obtaining from the insurance provider and have to settle it with rate of interest.

Some social media sites messages suggest making use of cash money value from entire life insurance policy to pay down bank card debt. The idea is that when you repay the loan with passion, the quantity will be returned to your financial investments. Unfortunately, that's not exactly how it works. When you pay back the car loan, a portion of that passion goes to the insurer.

For the very first a number of years, you'll be paying off the commission. This makes it exceptionally challenging for your plan to accumulate value during this time. Unless you can manage to pay a few to a number of hundred bucks for the next decade or even more, IBC will not function for you.

Infinite Banking Wealth Strategy

Not everyone must count only on themselves for financial safety and security. If you need life insurance coverage, below are some beneficial suggestions to consider: Consider term life insurance. These plans give protection during years with significant monetary commitments, like home loans, pupil loans, or when caring for kids. Ensure to look around for the finest rate.

Picture never having to worry about bank car loans or high rate of interest prices again. That's the power of unlimited financial life insurance policy.

There's no set loan term, and you have the freedom to choose the settlement schedule, which can be as leisurely as paying back the financing at the time of death. Privatized banking system. This flexibility encompasses the servicing of the finances, where you can choose for interest-only payments, keeping the funding equilibrium level and convenient

Holding money in an IUL taken care of account being attributed interest can commonly be far better than holding the cash on deposit at a bank.: You've always imagined opening your very own bakery. You can borrow from your IUL policy to cover the initial costs of renting an area, buying equipment, and working with team.

How do I track my growth with Life Insurance Loans?

Personal fundings can be gotten from traditional financial institutions and lending institution. Right here are some vital factors to think about. Credit history cards can provide a versatile method to obtain cash for very short-term periods. Nevertheless, borrowing cash on a charge card is typically extremely costly with annual percent prices of interest (APR) frequently getting to 20% to 30% or even more a year - Infinite Banking for financial freedom.

Latest Posts

How Does Bank On Yourself Work

Infinity Banking

Byob: How To Be Your Own Bank