All Categories

Featured

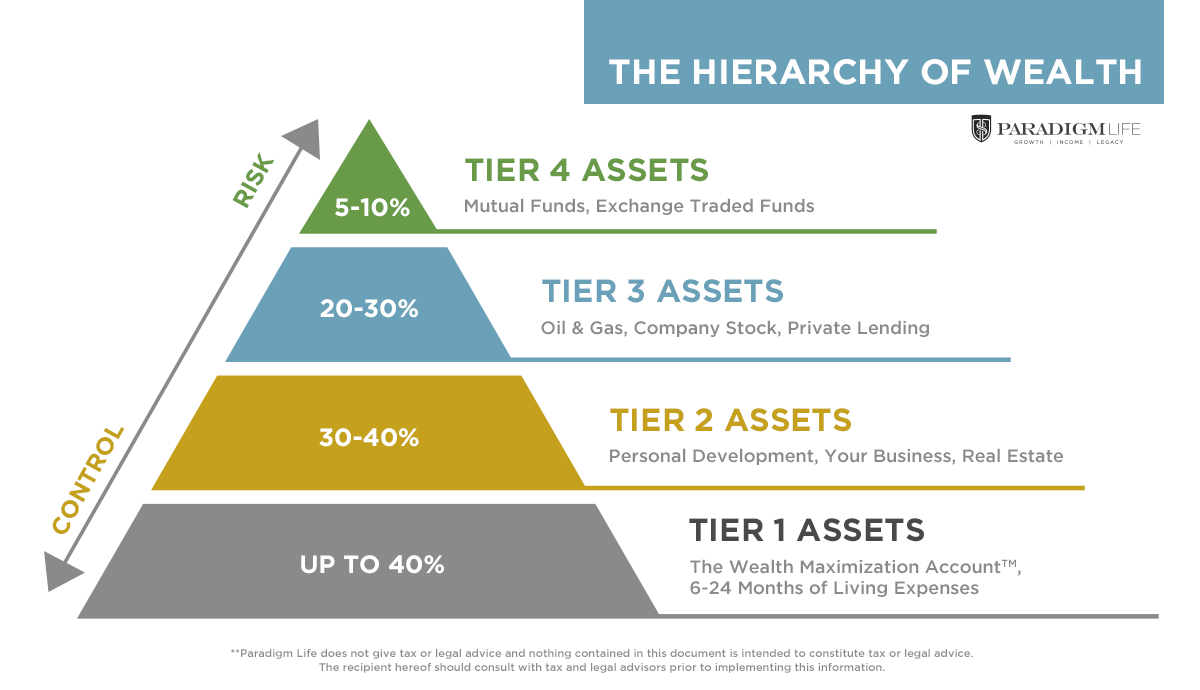

Whole life insurance coverage plans are non-correlated assets. No matter of what happens in the market (stock, genuine estate, or otherwise), your insurance plan preserves its well worth.

Market-based financial investments expand wealth much faster yet are revealed to market fluctuations, making them naturally dangerous. Suppose there were a third pail that provided safety and security however also moderate, surefire returns? Entire life insurance coverage is that third pail. Despite exactly how diversified you believe your profile may be, at the end of the day, a market-based investment is a market-based investment.

By leveraging a whole life policy, business owners eliminate reliance on banks. how to use infinite banking to eliminate debt.

With Infinite Banking, business owners control their own financing, ensuring predictable funding for future needs.

Insurance brokers can help structure the right Infinite Banking policy. Discover how to integrate Infinite Banking into your business to build long-term wealth.

Latest Posts

How Does Bank On Yourself Work

Infinity Banking

Byob: How To Be Your Own Bank